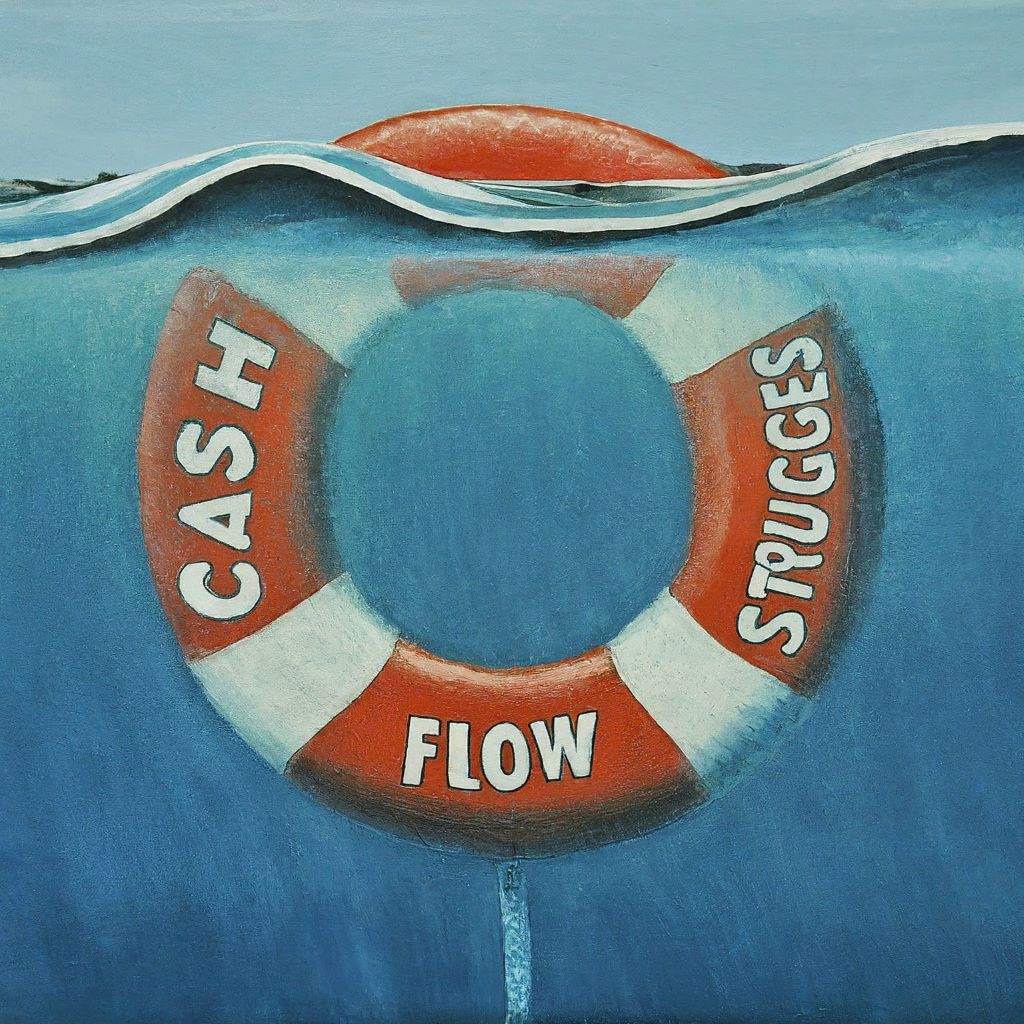

Cash flow, the lifeblood of any business, refers to the movement of money in and out of your company. It’s not just about profit; it’s about having enough available cash to cover ongoing expenses like rent, payroll, and inventory. Cash flow problems are a major reason many businesses fail, often because the warning signs are missed until it’s too late.

This article equips you to identify potential cash flow issues early, whether you’re a seasoned entrepreneur or just starting. By recognizing the red flags and taking proactive steps, you can steer your business toward a secure financial future.

Beyond the Basics: A Balancing Act

While profit is a good indicator of a healthy business, it doesn’t necessarily reflect your cash flow situation. Imagine a scenario where you make a large sale on credit. The profit looks great on your income statement, but the cash won’t arrive until your customer pays – potentially weeks or even months later. In the meantime, you might struggle to cover immediate bills.

This is where cash flow management comes in – it’s about understanding the timing of your cash inflows and outflows. A business consultant, Tiffany Manning, emphasizes, “Cash flow is like a seesaw. You need to balance your incoming cash with your outgoing expenses to avoid tilting towards a negative position.”

Spotting the Warning Signs: Early Detection is Key

Here are some crucial signs to watch out for that might indicate looming cash flow problems:

- Living paycheck to paycheck: This applies to businesses too. If you’re constantly relying on new income to cover existing expenses, it’s a sign your cash flow is stretched thin.

- Increasing reliance on debt: While credit cards and loans can be helpful tools, continuously using them to cover operational costs suggests a cash flow imbalance.

- Delays in paying vendors: Are you struggling to pay suppliers on time? This can damage your reputation and disrupt your supply chain, further hindering your cash flow.

- Overstocked inventory: Excess inventory ties up valuable cash that could be used elsewhere. Aim for a healthy balance between having enough stock to meet demand and not being over-invested in products that might not sell quickly.

Unique Insights: Digging Deeper

Cash flow issues can also arise from more strategic sources:

- Unrealistic sales forecasts: Overly optimistic projections can lead to overspending based on anticipated, but unrealized, revenue.

- Poor customer credit vetting: Selling to customers with a history of late payments can create delays in receiving your cash.

- Failure to adapt to changing markets: If your pricing strategy doesn’t reflect market fluctuations or customer buying habits, it can negatively impact your cash flow.

Related: What do bookkeepers do?

Taking Action: Proactive Strategies for a Healthy Cash Flow

Here are some steps you can take to address and prevent cash flow problems:

- Create a cash flow forecast: This will help you anticipate future cash inflows and outflows, allowing you to plan for potential shortfalls. There are user-friendly cash flow forecasting templates available online.

- Negotiate better payment terms: Try to extend your payment terms with vendors while offering early payment discounts to incentivize faster payments from customers.

- Track your key metrics: Closely monitor accounts receivable (money owed by customers) and accounts payable (money owed to vendors). This allows you to identify areas for improvement in your collection and payment cycles.

The Takeaway: Building Cash Flow Resilience

By recognizing the early signs of cash flow problems and taking proactive steps, you can safeguard your business from financial difficulties. Remember, cash flow is an ongoing process, not a one-time fix. Regularly monitoring your metrics, forecasting your future needs, and adapting your strategies will ensure your business has the financial fuel it needs to thrive.